The regulatory landscape in financial services continues to grow more complex each year. Financial institutions must reconsider their operational models and risk management approaches as new AI technologies emerge. Manual compliance reviews are no longer sufficient to keep pace with evolving regulations and increasing transaction volumes. AI agents offer a transformative solution by automating compliance checks, detecting risky language, and maintaining comprehensive audit trails that satisfy regulatory requirements.

Understanding AI Agents in Compliance Automation

AI agents represent a sophisticated evolution beyond traditional rule-based systems. These intelligent systems combine natural language processing, machine learning classifiers, and contextual analysis to understand regulatory requirements and flag potential violations.

The integration of generative AI and large language models offers transformative potential to automate compliance processes, detect anomalies, and provide comprehensive insights into regulatory requirements.

Unlike static software, AI agents learn from patterns, adapt to new regulations, and improve their accuracy over time through continuous feedback loops.

Core Components of Compliance Agents

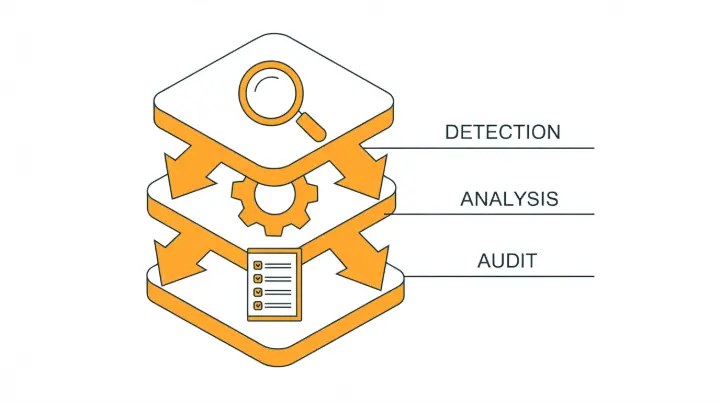

A robust compliance agent system requires three fundamental components working in concert. The detection layer continuously monitors communications, transactions, and documents for potential compliance issues.

The analysis layer evaluates flagged content against established rule sets and regulatory frameworks. The audit layer creates immutable records of all checks, decisions, and actions taken.

This architecture ensures both effectiveness in catching violations and transparency for regulatory audits.

The prompt engineering component serves as the brain of the system. Well-crafted prompts guide the AI agent to recognize subtle compliance risks that simple keyword matching would miss.

For example, a prompt might instruct the agent to identify language that could constitute financial advice without proper disclaimers, detect potential market manipulation signals, or flag communications that might violate fair lending practices.

Sample Rule Sets for Financial Compliance

Building effective compliance automation starts with translating regulatory requirements into actionable rule sets. Here are practical examples that compliance engineers can adapt:

Anti-Money Laundering (AML) Detection:

- Flag transactions above $10,000 without proper documentation

- Identify patterns of structured deposits designed to avoid reporting thresholds

- Detect references to high-risk jurisdictions or sanctioned entities

- Monitor for unusual transaction timing or frequency patterns

Consumer Protection Rules:

- Identify marketing materials lacking required disclosures

- Detect language that could mislead consumers about fees or terms

- Flag communications containing prohibited claims about investment returns

- Monitor for accessibility compliance in digital communications

Market Conduct Standards:

- Detect potential insider trading language in communications

- Identify conflicts of interest that require disclosure

- Flag recommendations without adequate suitability assessments

- Monitor for manipulative language in market commentary

Implementing the Prompt and Classifier Combination

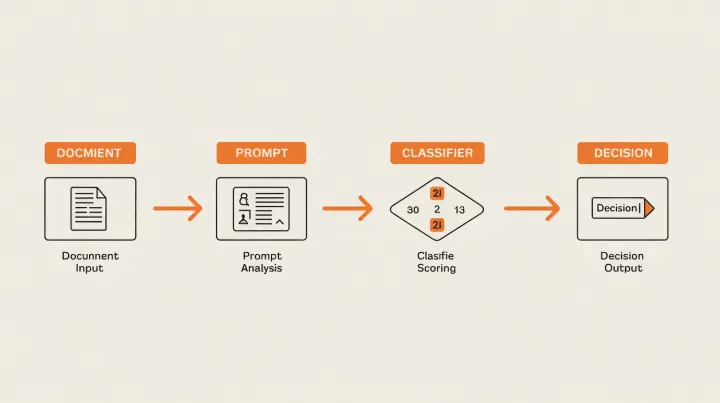

The most effective compliance agents use a two-stage approach combining carefully designed prompts with trained classifiers. The prompt layer provides context and instructions for the AI agent, while the classifier layer applies statistical models to determine violation probability.

Here is a sample implementation pattern:

Stage 1: Contextual Prompt

You are a compliance monitoring agent for a registered investment advisor. Analyze the following client communication for potential regulatory violations. Consider these specific regulations: - Investment Advisers Act Rule 206(4)-1 (advertising rule) - SEC Regulation Best Interest - FINRA Rule 2210 (communications with the public) Identify any language that: 1. Makes performance claims without required disclosures 2. Uses testimonials improperly 3. Omits material risk information 4. Could mislead a reasonable investor For each potential issue, cite the specific regulation and explain the concern.

Stage 2: Classifier Validation

After the prompt-based analysis, a trained classifier scores the output across multiple dimensions:

- Violation severity (low, medium, high, critical)

- Confidence level (0-100%)

- Regulatory category (AML, consumer protection, market conduct)

- Required action (flag for review, block transmission, escalate immediately)

This combination reduces false positives while maintaining high sensitivity to genuine compliance risks. Regular audits of AI systems help identify and rectify biases, inaccuracies, or vulnerabilities, ensuring the system remains accurate and fair.

Creating Comprehensive Audit Trails

Regulatory examinations require detailed documentation of compliance processes and decisions. AI agents excel at generating comprehensive audit trails that satisfy regulatory scrutiny while reducing manual documentation burden.

An effective audit logging pattern captures:

- Timestamp and user identity for every transaction or communication reviewed

- Complete input data (with appropriate privacy protections)

- AI agent analysis including specific rules triggered

- Confidence scores and risk classifications

- Human reviewer decisions for escalated items

- Follow-up actions taken and their outcomes

The logging system should implement immutability guarantees to prevent tampering. Blockchain-based or cryptographically signed logs provide additional assurance. Financial institutions must develop comprehensive governance strategies and ensure implementations adhere to regulatory standards, which includes maintaining tamper-proof audit records.

Query capabilities are equally important. Compliance officers must quickly retrieve relevant logs during examinations. Implement filtering by date range, rule type, risk level, reviewer, and outcome. Support export to standard formats for regulatory submission.

Technical Implementation Considerations

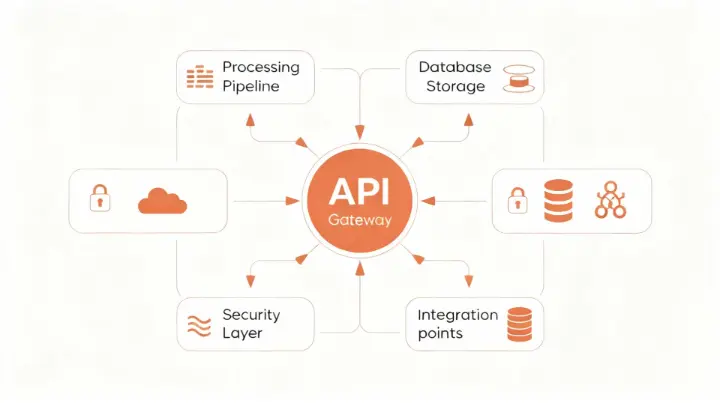

Deploying compliance agents requires careful attention to infrastructure, security, and integration patterns. The system must process high volumes of transactions and communications with minimal latency while maintaining strict data security standards.

Architecture best practices include:

- Microservices design for scalability and maintainability

- Real-time processing pipelines for time-sensitive checks

- Secure API gateways for integration with existing systems

- Encrypted storage for sensitive compliance data

- Role-based access controls for audit logs and system configuration

Embedding AI compliance checks into broader governance frameworks and maintaining modular documentation that can be updated as laws evolve ensures adaptability. This modular approach allows rapid updates when regulations change without requiring complete system overhauls.

Balancing Automation with Human Oversight

While AI agents dramatically improve efficiency, human expertise remains essential. Automation allows compliance officers to focus on more complex decision-making rather than routine screening tasks. The optimal approach combines automated first-level screening with human review of flagged items.

Establish clear escalation criteria. Low-risk automated approvals proceed without human review. Medium-risk items receive automated flagging with human verification before final approval. High-risk situations trigger immediate escalation to senior compliance personnel. This tiered approach maximizes efficiency while maintaining appropriate oversight.

Continuous improvement processes are vital. Review false positives and false negatives regularly. Retrain classifiers based on human reviewer feedback. Update prompts to address emerging compliance risks. This iterative refinement ensures the system becomes more accurate and useful over time.

Measuring Success and ROI

Quantifying the impact of compliance automation helps justify investment and guide improvements. Track metrics across multiple dimensions to build a complete picture of system performance.

Efficiency metrics include processing time per review, percentage of items requiring human review, and total volume handled. Accuracy metrics track false positive rates, false negative rates, and agreement between AI and human reviewers. Risk metrics monitor violations caught, potential fines avoided, and examination findings.

Financial impact analysis should consider direct cost savings from reduced manual review hours, indirect benefits from improved risk management, and strategic value from enhanced regulatory relationships. Most organizations see positive ROI within 12-18 months of deployment when properly implemented.

Future Directions and Emerging Trends

The compliance automation landscape continues to evolve rapidly. AI shows promise in helping manage complicated and changing requirements while giving human representatives more time to focus on strategic compliance efforts. Emerging capabilities include predictive compliance that identifies potential violations before they occur, natural language interfaces that allow compliance officers to query systems conversationally, and federated learning approaches that improve models while maintaining data privacy.

Integration with regulatory technology ecosystems will deepen. Expect tighter connections between compliance agents, regulatory reporting systems, and direct regulatory submission platforms. Some jurisdictions are exploring standardized APIs for compliance reporting that AI agents can populate automatically.

Getting Started with Compliance Agents

Organizations ready to implement compliance automation should begin with a focused pilot project. Select a specific compliance domain with clear rules and measurable outcomes. Assemble a cross-functional team including compliance experts, data scientists, and engineering resources.

Start by documenting current manual processes and identifying high-volume, rule-based tasks suitable for automation. Develop initial rule sets and prompts collaboratively between compliance and technical teams. Build a minimum viable system and test thoroughly with historical data before processing live transactions.

Plan for change management and training. Compliance staff need to understand how the system works, when to trust its recommendations, and how to provide feedback. Clear communication about the agent's role as a tool supporting human judgment, not replacing it, helps ensure adoption and success.

The regulatory environment will only become more complex. Financial institutions that embrace AI-driven compliance automation position themselves to navigate this complexity efficiently while maintaining the highest standards of regulatory adherence. The technology has matured sufficiently that implementation risk is now lower than the risk of falling behind in compliance capabilities.