AI Agents That Think for Themselves

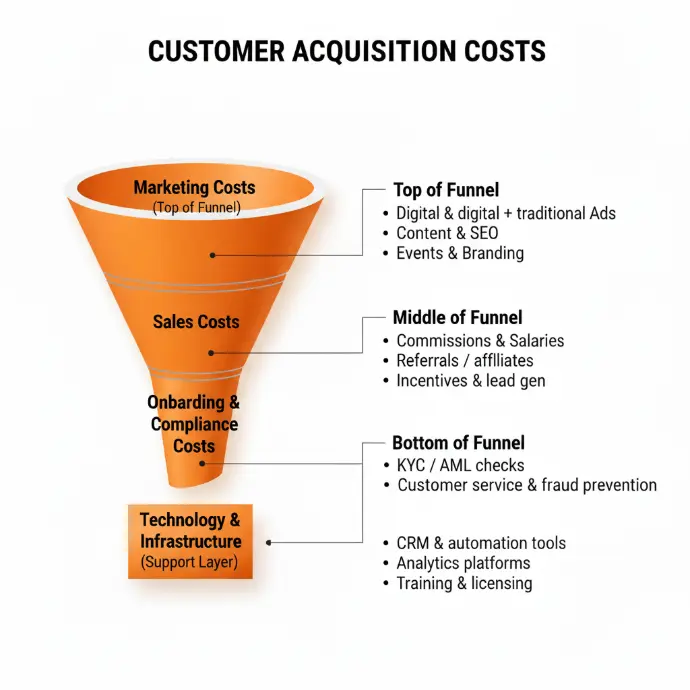

Financial services organizations often struggle with high customer acquisition costs and inefficient workflows. Human teams spend significant time analyzing data, identifying leads, and coordinating outreach, which limits scalability and slows revenue growth. Trixly AI agents act as intelligent assistants that think proactively. s.

Smarter Automation with Agentic AI

By handling complex workflows from document verification to fraud detection, it speeds up critical processes without adding risk. This automation reduces operational costs, improves customer satisfaction by shortening turnaround times, and allows teams to redirect their efforts toward revenue-generating activities. With Agentic AI, financial services can scale operations efficiently without sacrificing quality or compliance.

Natural Voice AI Conversations

Customer engagement is a major pain point for financial services, especially when trying to reduce churn and increase cross-selling opportunities. Traditional call centers are expensive, and customers often experience long wait times and impersonal interactions. Trixly AI’s natural Voice AI enables realistic, multilingual conversations that can handle customer support, lead qualification, and personalized outreach at scale.

Protecting Your Creative Assets with AI Cloud Security

Trixly AI provides advanced AI-powered cloud security that ensures data is safeguarded throughout the lifecycle. From storing customer records to processing payments, the system detects threats, monitors access, and prevents unauthorized use. By reducing risk and ensuring regulatory compliance, financial institutions can scale operations confidently, innovate faster, and maintain trust with their customers. Security becomes an enabler rather than a limitation, allowing growth without compromise.